Monthly debt includes all outstanding debt obligations:

For more details, please refer to the MAS website here: Total Debt Servicing Ratio for Property Loans

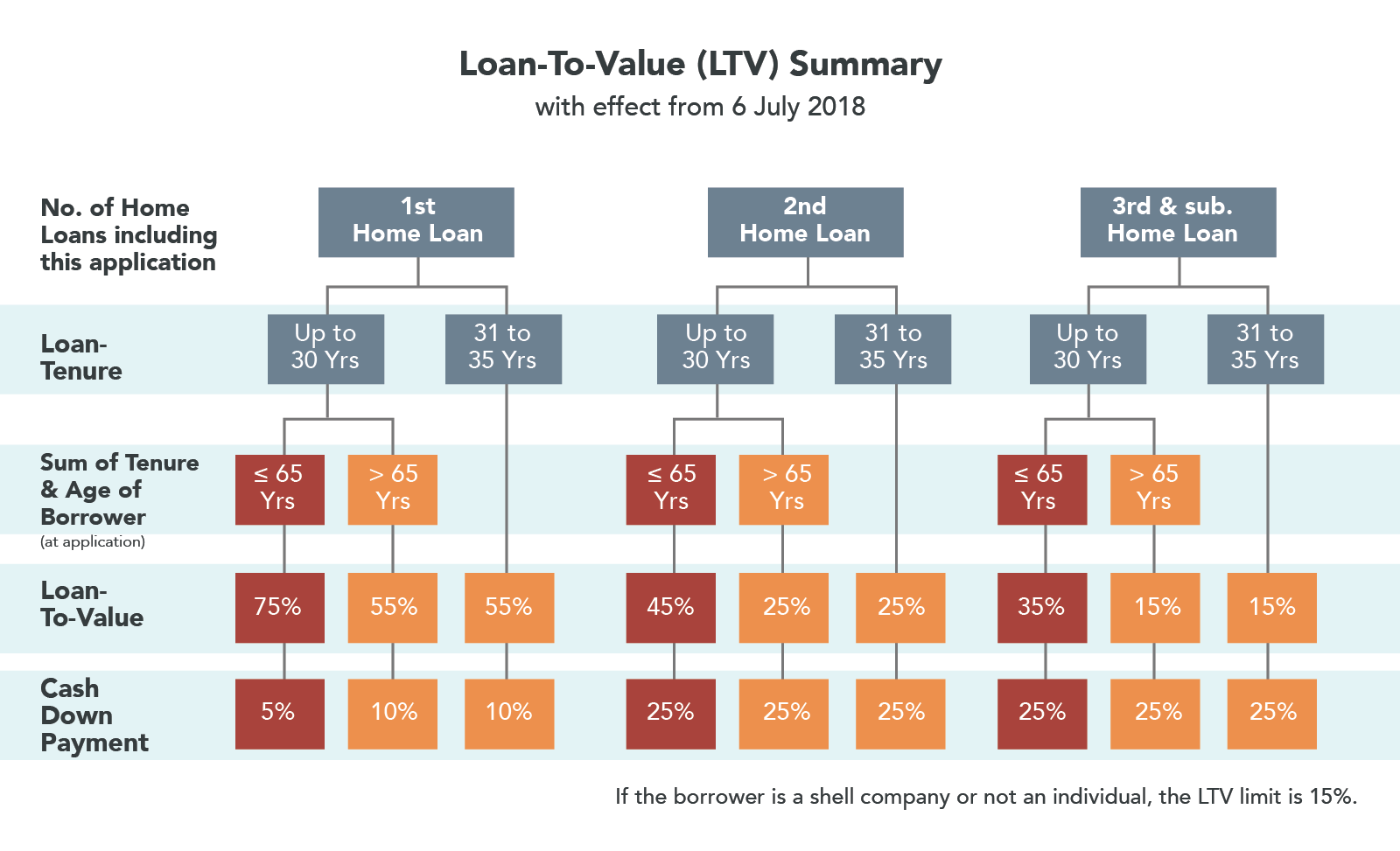

| First Loan | Second Loan | Third Loan | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Loan Tenure | Up to 30 years | 31-35 years | Up to 30 years | 31-35 years | Up to 30 years | 31-35 years | |||

| Age | Income Weighted Average Age | ||||||||

| Up to 65 | Up to 70-75 | Up to 70-75 | Up to 65 | Up to 70-75 | Up to 70-75 | Up to 65 | Up to 70-75 | Up to 70-75 | |

| Maximum LTV Limit | 75% | 55% | 55% | 45% | 25% | 25% | 35% | 15% | 15% |

| If the borrower is a shell company or not an individual, the LTV limit is 15% | |||||||||

| Minimum Cash Downpayment | 5% | 10% | 10% | 25% | 25% | 25% | 25% | 25% | 25% |

| Guarantors / Co-borrowers | All co-borrowers must be mortgagors. Guarantors must be co-borrowers if the latter did not pass the TDSR criteria. |

||||||||

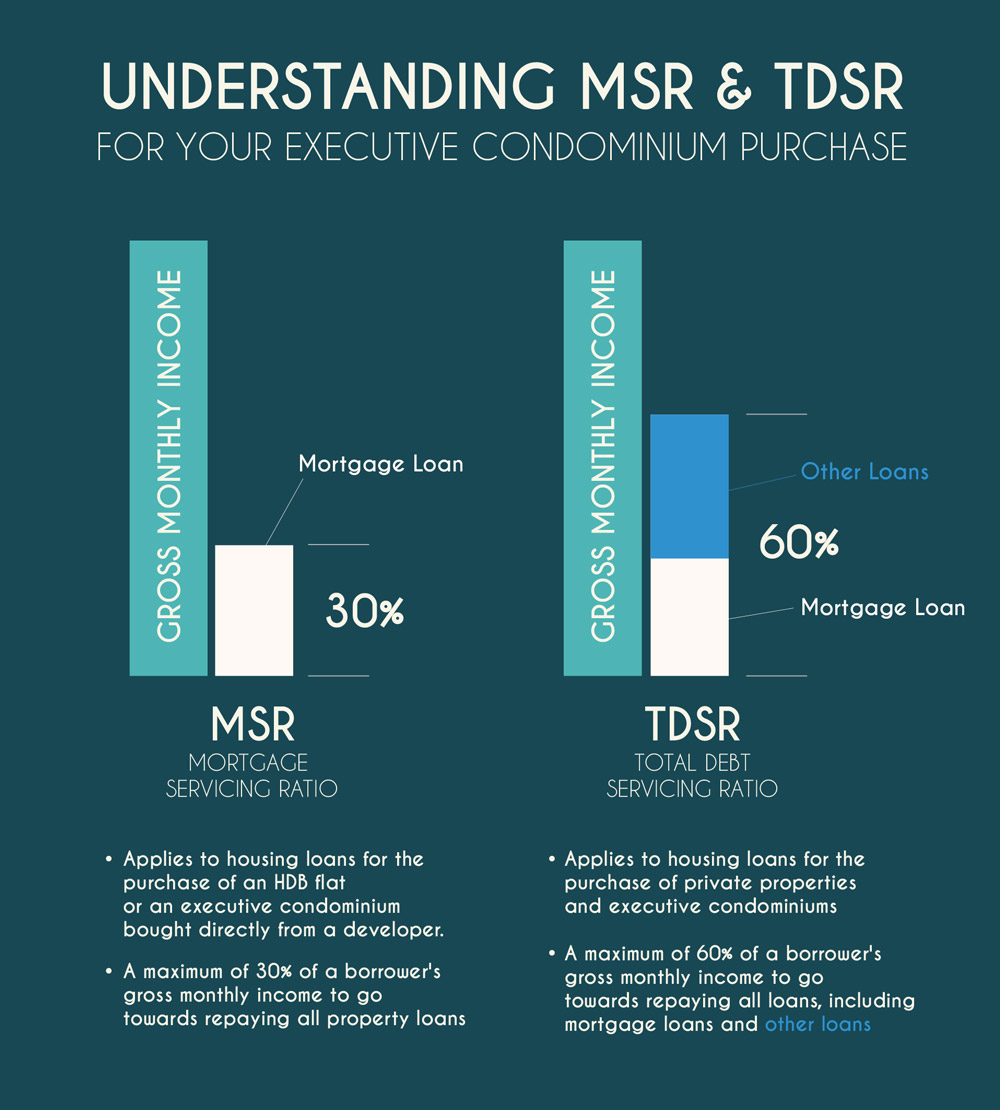

| Mortgage Servicing Ratio (MSR) (for ECs) | 30% | ||||||||

| Total Debt Servicing Ratio (TDSR) | 60% | ||||||||

| Stress Test Interest Rate | 3.5% | ||||||||

The loan-to-value (LTV) limit determines the maximum amount an individual can borrow from a financial institution (FI) for a housing loan.

LTV refers to the loan amount as a percentage of the property’s value. For example, if an individual borrows $750,000 to purchase a property valued at $1,000,000, the LTV is 75%.

It was announced on 5 July 2018 that LTV limits will be tightened as part of a package of measures to cool the property market and keep price increases in line with economic fundamentals.